CHOOSE YOUR PLATFORM

Become the Investor You Want to Be

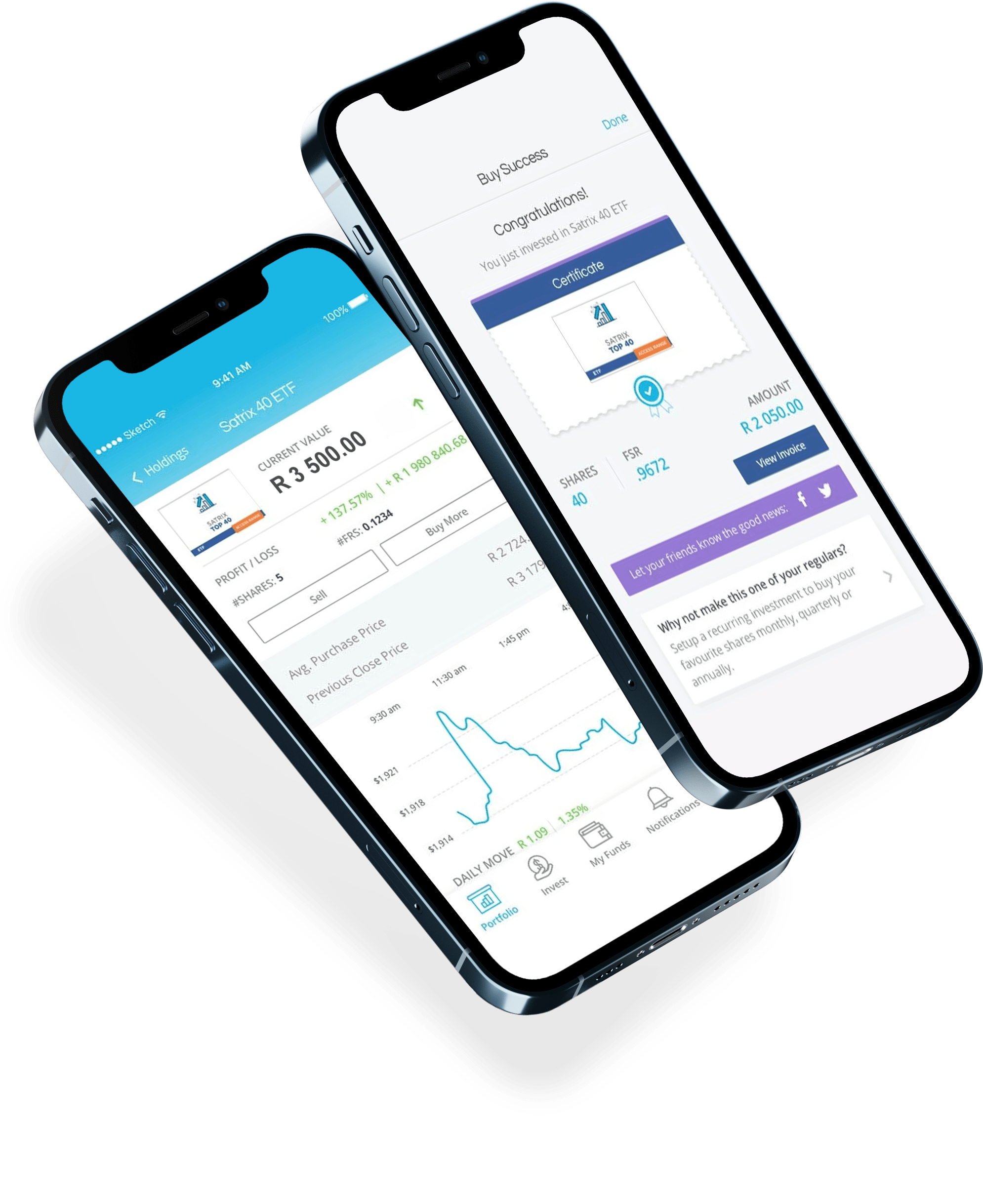

The complexity of investing can put anyone off. We exist to make it simple. Our investment platform, SatrixNOW,

puts a choice selection of low-cost, award-winning funds at your fingertips. And with no minimums,

you can start building a portfolio to be proud of, today.

Getting Started

An Introduction to Tracker Funds | Considerations with ETFs or Unit Trusts | Benefits of Tax-free Investing |

Index tracking funds do exactly what the name suggests - they track or replicate a particular index. | Satrix offers both Exchange Traded Funds (ETFs) and Unit Trusts - here are some important considerations when deciding which one is right for you. | Have a look below to see how tax-free savings accounts work, then click here for funds options. |

Test Drive Our Funds

Let’s set your imagination free. Choose any amount you might have invested, select one of our top performing funds, enter the year you were so diligent, sit back and witness the power of investing. If that number were real, how would you feel?

STEP 1. CONTRIBUTION

STEP 2. FUND

Where applicable dividends are reinvested. This calculation only includes fund charges (platform & admin fees are excluded).

STEP 3. YEAR

VALUE

Why Invest with Us

No Minimums

Start with R1 or add a couple of 0s.

LOW COST

Low fees high returns, as they say.

Invest in anything

Local or global, it's your call.

Awards

Fraud Awareness

Satrix does not use WhatsApp groups, reps or salespeople to solicit investments.

Be alert of scammers promising overnight returns! If you are unsure, contact us.